Coinbase a better investment than Bitcoin? A perspective on asymmetric bets

Recently, the venerable (to put it nicely) Chamath Palapithaya said he missed out on an early opportunity to invest directly into Coinbase and, in the end, making that investment would have resulted in a better return than his investment in Bitcoin.

I’m not an investor in @coinbase. I totally missed it. That said, I also got really lucky because many years earlier, I invested as an LP with an investor who owns a large stake.

— Chamath Palihapitiya (@chamath) April 6, 2021

What did I get wrong?

What did he get right? https://t.co/YgA4scuyxX

Fair enough, but even the best companies are hard to identify early in their existence. Chamath certainly has the right to reflect on missing this one, though it looks like he came out OK in the end and, more importantly, he had access to both investment opportunities.

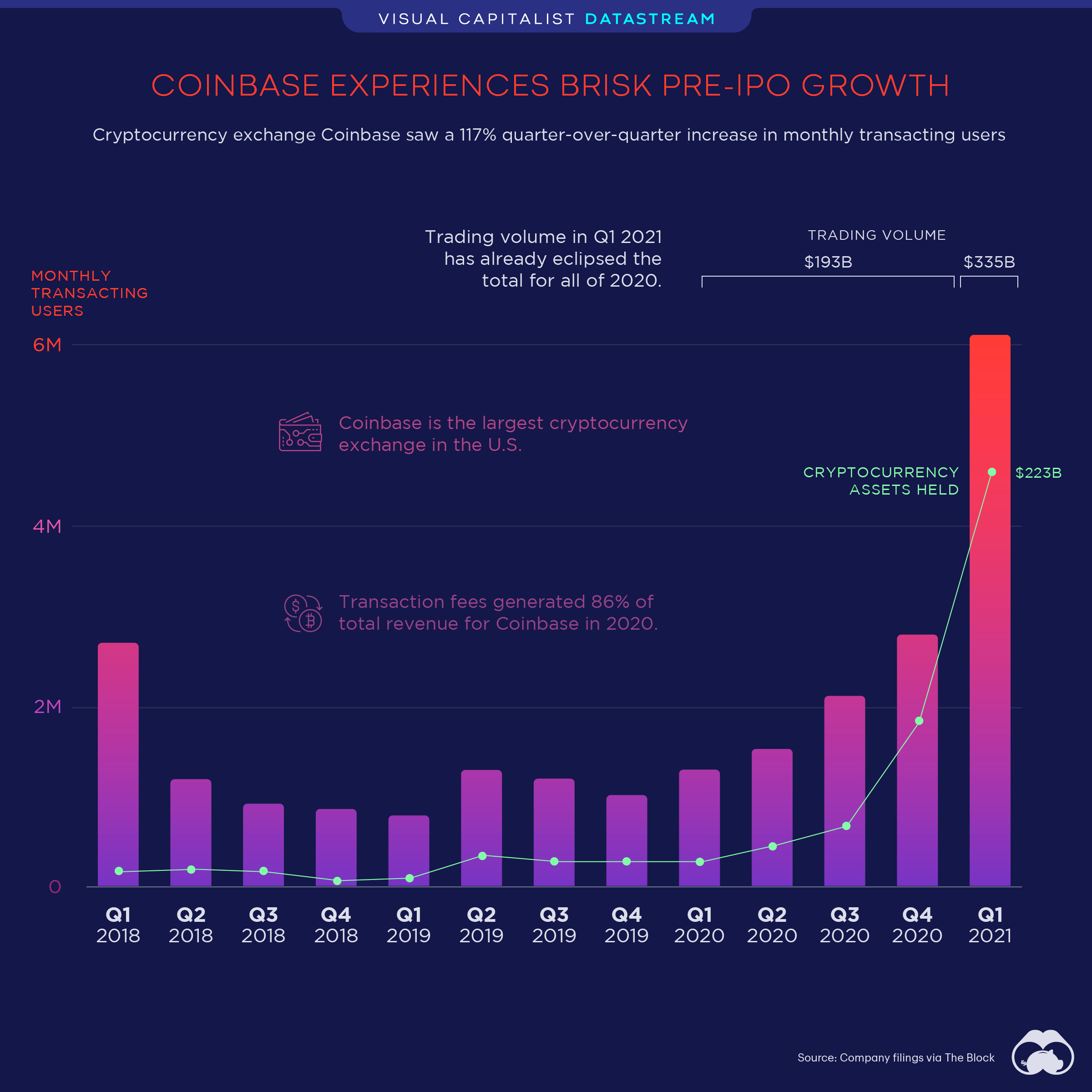

Full credit to the team at Coinbase, who have created one of the most valuable and interesting companies in the world in less than a decade. Much has been made of Coinbase’s compelling pre-IPO economics, while there has also been chatter about how the company’s trajectory includes material risks... we won’t spend a lot of time on this, as there is already plenty to read about on the topic.

What we do want you to think about is something that few have realized - the simple fact that we can compare the economics of Bitcoin & crypto to the economics of an early investment in a venture-backed startup... and that everyone has access to the economics of Bitcoin & crypto. Despite the great progress that folks that companies like AngelList have made in recent years in broadening access to some of the best private companies on the planet, it is still a tough asset class to access.

How to Get Rich (without getting lucky):

— Naval (@naval) May 31, 2018

Per one of our colleagues at Avicenna, “not sure it's obvious to the average investor that they can't access VC deals - the reason this system has worked for so long is because the average person doesn't even know they are being excluded from the opportunity.” So, even if you want to make that trade, you often can’t - at least not with optimal visibility of risk vs reward. There are many nuggets of wisdom from @naval on how angel investors should organize themselves to access these types of returns and, while he offers great insight, he also underscores how difficult it is for the average investor to access these types of opportunities and calibrate risk. While we are always happy to listen to Naval, most of us don’t have the time, access, or resources to be successful venture investors.

A unique opportunity

High quality, asymmetric return opportunities do not necessarily grow on trees, but you can find them if you look hard enough, and individual investors have never had an opportunity like this before. Yet, every week, Avicenna speaks with individuals who have a zero allocation to crypto. These are doctors, lawyers, technologists, real estate investors, and even successful entrepreneurs.

The Fourth Turning is upon us.

— Raoul Pal (@RaoulGMI) April 6, 2021

Expect everything to change.

I get the feeling the next 10 years will be nothing like the last 30 years and the asymmetric risks are now skewed to the upside and not downside, but downside risks are not eliminated, of course...

In terms of an overall asset allocation, ‘experts’ have started to get comfortable with the suggestion that anywhere from 1-5% of a portfolio would be reasonable to allocate to assets with an asymmetric return profile. The math is pretty simple - would you be prepared to lose a portion of a $10,000 investment if there is a reasonable prospect of making $100,000, or even $500,000? If this represents an appropriate, risk-adjusted portion of your portfolio, the answer should be yes - particularly given that the risk of certain crypto assets (like Bitcoin) going to zero is significantly lower than it was only a few years ago.

For every investor, it is very important to calibrate what an appropriate, risk-adjusted portion represents, as this is different for everyone. It is also important to understand that volatility will persist for some time in the crypto asset class - that is a given. Those following the market closely will know that we have just seen a quick and significant drop in the value of Bitcoin and other large-cap cryptocurrencies in what felt like an instant. While volatility is expected to persist for some time, some observers expect these types of events will become less frequent. Regardless of what happens from a volatility perspective, accessing opportunities like this comes with its share of risks, and investors are well served to pay attention, establish a view, and adjust accordingly.

To summarize

Crypto provides a similar return opportunity to venture, is more accessible, and it is fairly early in the game. Getting involved means learning - from both hits and misses - and learning leads to improvement over time. Unlike with the early investment opportunity in Coinbase, where you had to have access to the deal like Chamath did, Bitcoin and other cryptocurrencies offer an opportunity to participate. Don't necessarily bet the farm, understand that there will be volatility, and be aware that you now have direct access to asymmetric bets with a portion of your portfolio.