Plan B (Bitcoin): stock to flow (S2F) explained

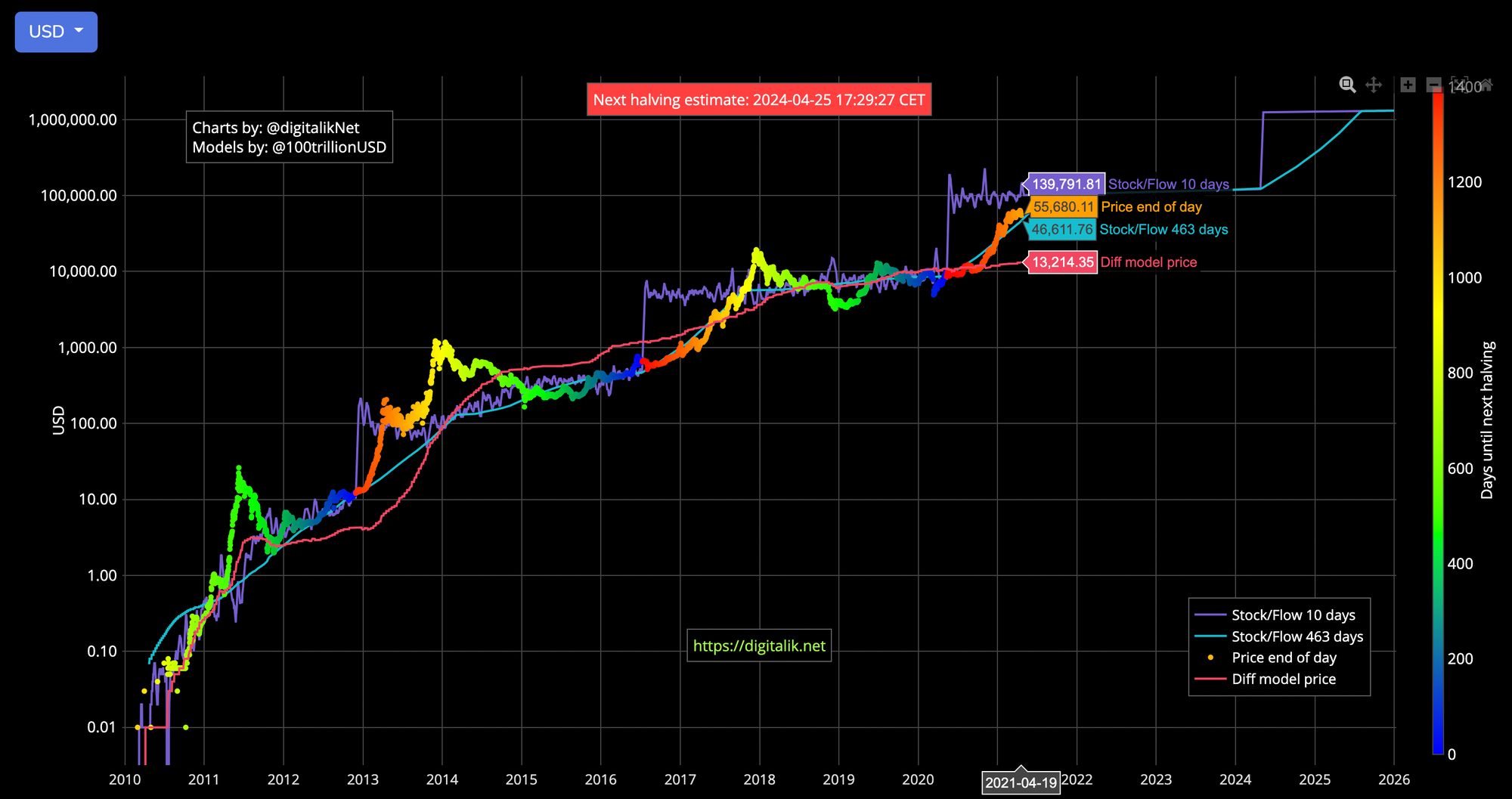

Plan B (@100TrillionUSD) first wrote his article about modelling Bitcoin's value with scarcity in March 2019. In the article, he outlines the stock to flow (S2F) ratio as a number that shows how many years, at the current production rate, are required to achieve the current stock. The higher the number, the higher the price.

Explain it to me like I'm 5

Bitcoin is an emerging store of value akin to other scarce commodities like gold, silver and platinum. All of these tend to retain value over longer periods of time due to their scarcity. Bitcoin, being the first-ever massively adopted digitally scarce asset, is still emerging because not everyone fully understands the engineered scarcity and supply rate (via mining) that is built into the Bitcoin network.

There will only ever be 21 million bitcoins. To date - since 2009 - 18.5 million coins have been mined. On a daily basis, without getting overly technical, roughly 900 bitcoins are rewarded to miners. Now here's the kicker: that number gets halved every 4 years until there are zero. So up until May 2020, the most recent halvening, 1,800 bitcoins were being rewarded on a daily basis. In 4 years, only 450 bitcoins will be rewarded each day.

This engineered scarcity becomes even more apparent if you consider the amount of Bitcoin infrastructure being built every day by new companies and existing exchanges. With an increasing demand for Bitcoin and a pre-defined supply rate, the price of 1 bitcoin has (and likely will) continue to go up.

What about stock to flow?

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year).

For store of value (SoV) commodities like gold, platinum, or silver, a high ratio indicates that they are mostly not consumed in industrial applications. Instead, the majority is stored as a monetary hedge, thus driving up the stock-to-flow ratio.

A higher ratio indicates that the commodity is increasingly scarce - and therefore more valuable as a store of value.

As of April 20, 2021 close, the projected S2F model price for bitcoin is $50,223.94, while it closed at $56,474.37.

Stock-to-Flow Multiple (463d)

— S2F Multiple (@s2fmultiple) April 21, 2021

2021-04-20, 23:59 UTC

ln(actual / model)

Actual price: $56,474.37

Model price: $50,223.94

S2F multiple: 0.12 pic.twitter.com/00OCQdxfJO

Some maths and tl;dr:

SF = stock / flowStock is the size of the existing stockpiles or reserve. Flow is the yearly production.

In simple terms:

Stock = how many bitcoins are currently in circulation

Flow = how many bitcoins are created each year

Why do we care?

Simply, the stock to flow model is important because it provides a consistent pricing model for bitcoin over time. If you ever want to know if the price of bitcoin is too high or too low, you can make a quick calculation to determine its value as per the model.

#bitcoin dipped a bit, but the supply shortage is real .. and growing pic.twitter.com/cfDQyKgkqH

— PlanB (@100trillionUSD) April 18, 2021