Smart contracts on Bitcoin

Most people following the crypto space have heard of Ethereum and Binance smart contracts before. They are the underlying technology behind many decentralized finance (DeFi) tokens and protocols like Aave, Compound, Autofarm and others.

But the Bitcoin network does not inherently support smart contracts in this traditional sense. There are however, discrete log contracts (DLCs) which can be natively executed on the Bitcoin network.

What are DLCs?

DLCs or discrete log contracts are essentially multi-sig transactions that are settled over the Bitcoin network. Some people refer to them as invisible smart contracts because there is no real way to differentiate them from normal Bitcoin transactions. Irrespective of a smart contract, all the transactions are settled over the Bitcoin network. DLCs are not a new phenomenon however there has been more infrastructure development around Bitcoin smart contracts (in the form of DLCs).

How do DLCs work?

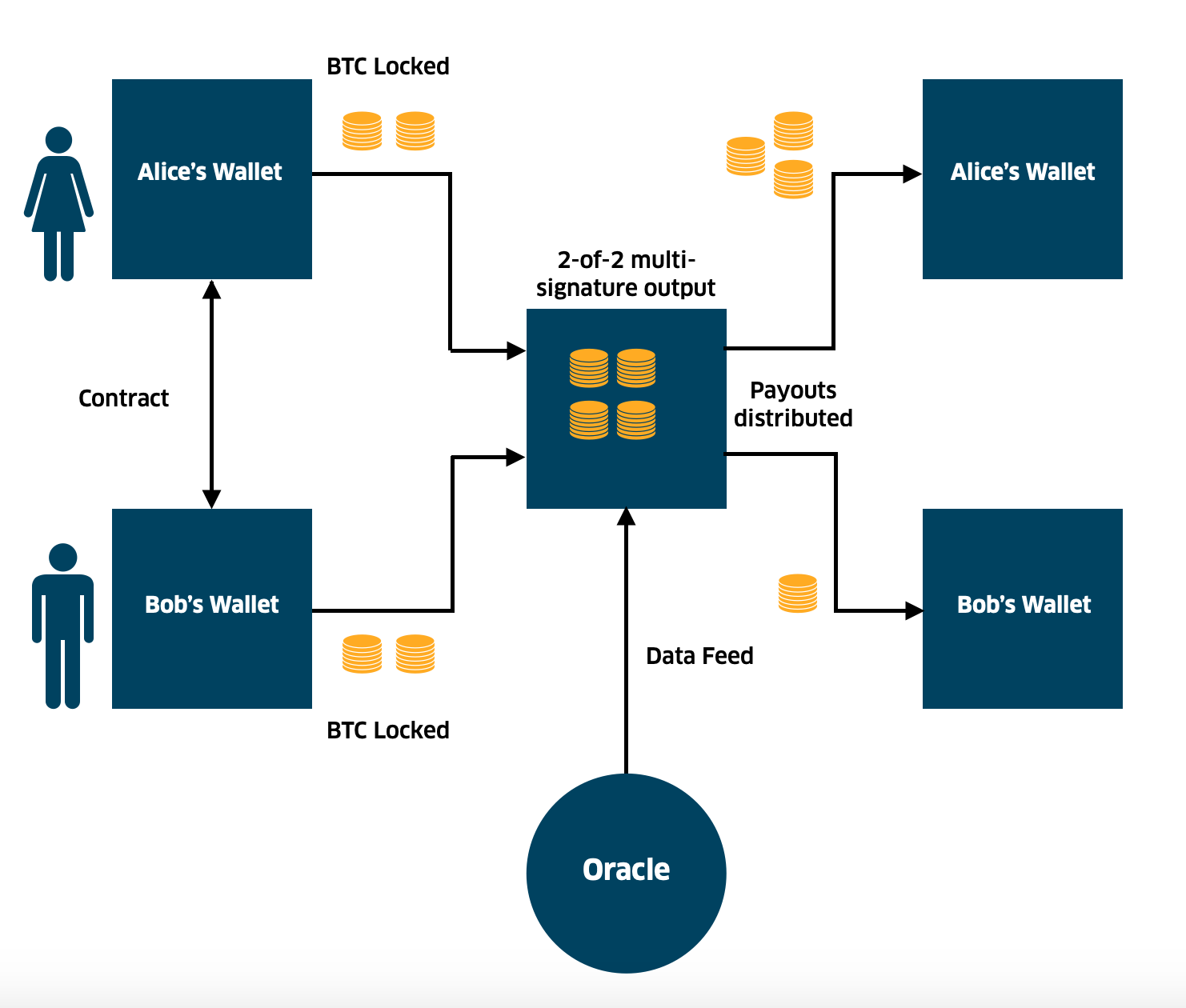

Two parties send funds to a multi-signature address. In order to settle the transaction, an oracle (a third-party arbitrator) would sign the contract with a signature that corresponds to the hash of the winning outcome. The person with the hash that corresponds with the oracle’s signature can then withdraw the funds from the contract.

DLC use cases

There are many use cases for smart contracts. The easiest representative usage would be for betting; sports, elections with more complex financial derivative markets in the future. You could for example, open a call option on a market equity, say APPL, with a defined strike price of $603.50, expiring in 12 months and the DLC could settle the winners and losers.

Here is an example of Nicolas Dorier using a DLC to bet on the 2020 US election winner:

I just entered in a bet via a DLC (with adaptor sig) with @Chris_Stewart_5 on the US elections.

— Nicolas Dorier (@NicolasDorier) September 8, 2020

He used https://t.co/mkXCUrNHLH

I used https://t.co/wgh1tP17i4 (not ready for others but me yet, will brush up this week and next week + vid) https://t.co/CKclefvG1F

Summary

Discrete log contracts are yet another use case in favour of Bitcoin. With the Lightning Network sidechain, Bitcoin transaction fees are essentially zero and instantaneous and now with a larger adoption of DLCs, these smart contracts can be settled in near real-time over the Lightning Network and ultimately settled over the Bitcoin network ledger. Meaning, in addition to holding BTC as a store of value, the entire financial derivatives market could be automatically settled over Bitcoin also.

With Bitcoin topping the network effect and store of value leaderboards, and with a looming increase of adoption in smart contracts via DLCs – Bitcoin is truly becoming the digital asset of the future.

Have a listen to this podcast episode where Preston Pysh talks about Bitcoin smart contracts with key influencers: