The great China ban

In May 2021, China reiterated its ban on crypto at a meeting of the State Council's Financial Stability and Development Committee chaired by Vice Premier Liu He. The Vice Premier vowed a crackdown on bitcoin mining and trading, citing both a financial risk to citizens and the energy consumption around mining. This week, Chinese authorities have been pushing harder to enforce their ban.

Yes, #bitcoin is banned in China

— Joel Birch 👨💻 (@BitcoinBirch) June 22, 2021

So is

Gmail

YouTube

Spotify

Buy what China bans is a good investment thesis historically 🤝

What does a ban on crypto in China mean?

Bitcoin mining has historically been heavily situated in China. Until recently, China accounted for between 65% and 75% of all Bitcoin mining.

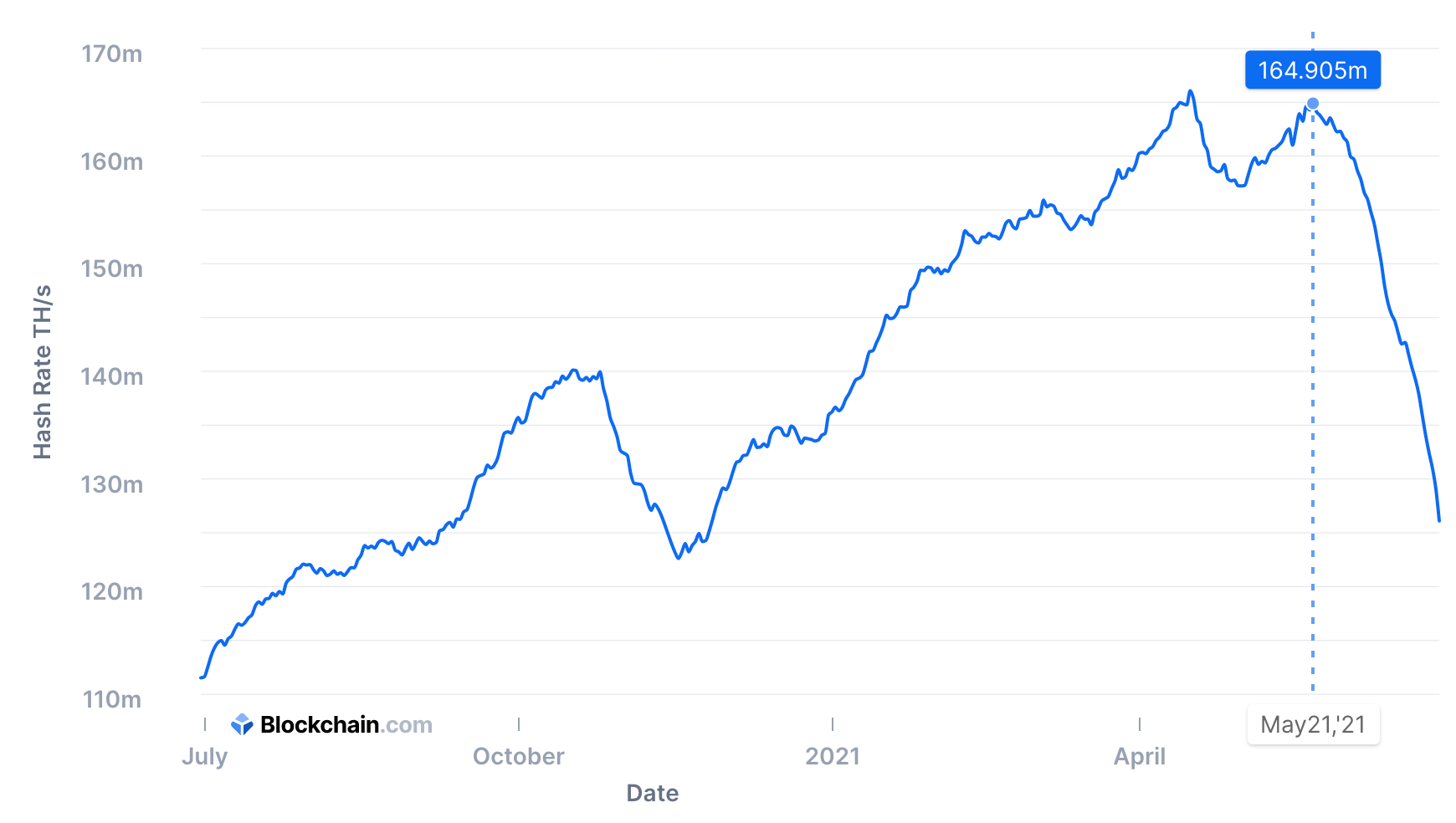

The above chart shows that the hash rate, a measure of the computational power used per second by the Bitcoin network, has fallen more than 50% from its peak in mid-April. It’s now at its lowest level since November 2020.

Given this ban and the global decrease in hash rate, the difficulty for Bitcoin mining has gone down. In other words, mining Bitcoin is a whole lot easier with fewer miners in the pool fighting for block rewards (bitcoins).

Enter stage left: The Americas

A decreased global hash rate creates new opportunities for further decentralization of Bitcoin mining. Canadian and US-based mining operations are scrambling to set up new equipment and infrastructure in order to capture mining rewards while Chinese miners plan their mining migrations to neighbouring countries.

With a more lucrative potential, mining companies are able to experiment with renewables and cleaner energies for long term sustainability. El Salvador has recently passed legislature to legitimize bitcoin as legal tender. They are now planning to mine bitcoin with power generated from volcanoes. Canadian mining company, Hut 8 has updated their corporate mandate to reduce the carbon footprint from mining as they continue to use a hybrid energy model. US-based, Square has partnered with a Blockstream to use solar energy to mine bitcoin.

Square and Blockstream are building a fully solar-powered #Bitcoin mining facility in the USA! 🙌

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) June 5, 2021

Go @Jack and @Adam3us ! 🚀

Summary

Given the much needed shift in global energy usage, corporations and governments around the world are pushing for a net-zero carbon future. Governments have created offset programs to fund research into renewable resources - Bitcoin mining is a fantastic way for new and existing companies to take advantage of these credits, while making the entire Bitcoin network more secure, sustainable and decentralized.

As the Bitcoin hash rate begins to ramp back up, it will be interesting to note the geographical make up of miners. Miners from China will likely continue to set up in neighbouring countries with cheap energy and new miners in the West will build infrastructure to mine with renewables like geothermal, nuclear, solar, wind and hydroelectric. The key takeaway here is that there will likely be a net increase in new miners, with the global hash rate will growing to greater levels over time.